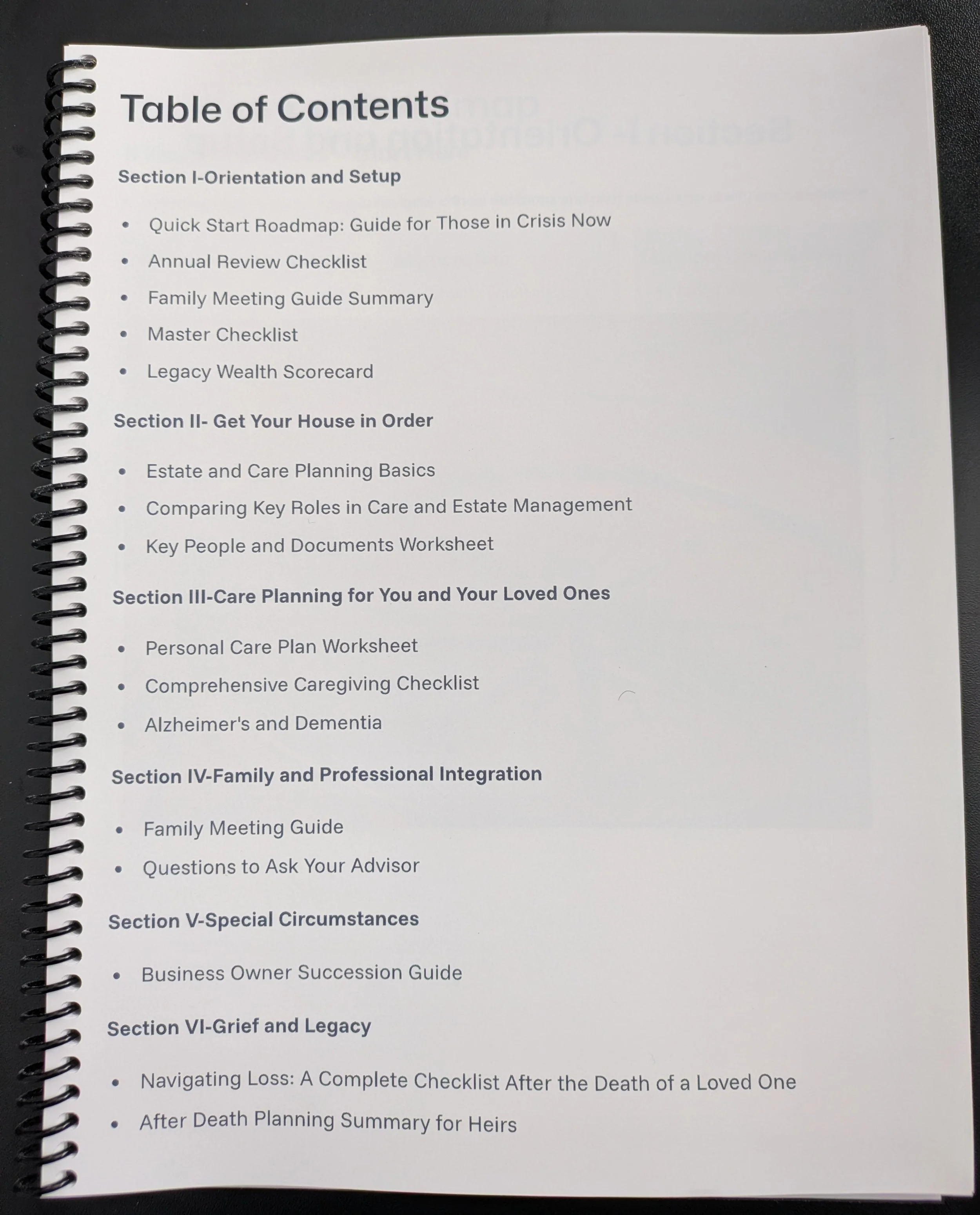

The Clarity Before Crisis Master Checklist is a simple, high-level guide designed to help you quickly identify your priorities across financial planning, legal preparation, healthcare decisions, caregiving, and legacy planning. It doesn’t overwhelm you with details or require hours of work. Instead, it gives you a clear overview of the major areas that need attention so you can decide what to tackle first.

This checklist helps you:

See the full landscape of what aging, caregiving, and retirement planning involve

Spot gaps you may not have considered—before they become urgent

Determine your first steps based on what feels most important or most unfinished

Organize your thinking before diving into the detailed guides, worksheets, and planning tools in the broader Clarity System

It walks you through big-picture categories like:

What wealth and priorities mean to you Clarity-Before-Crisis-Master-Ch…

Your financial essentials

Key legal documents

Healthcare and long-term care decisions

Family conversations

Caregiving roles and responsibilities

Your values, stories, and legacy intentions

Where and how to store important documents

The Master Checklist doesn’t try to solve everything.

It simply helps you see everything, so you can decide where to begin.

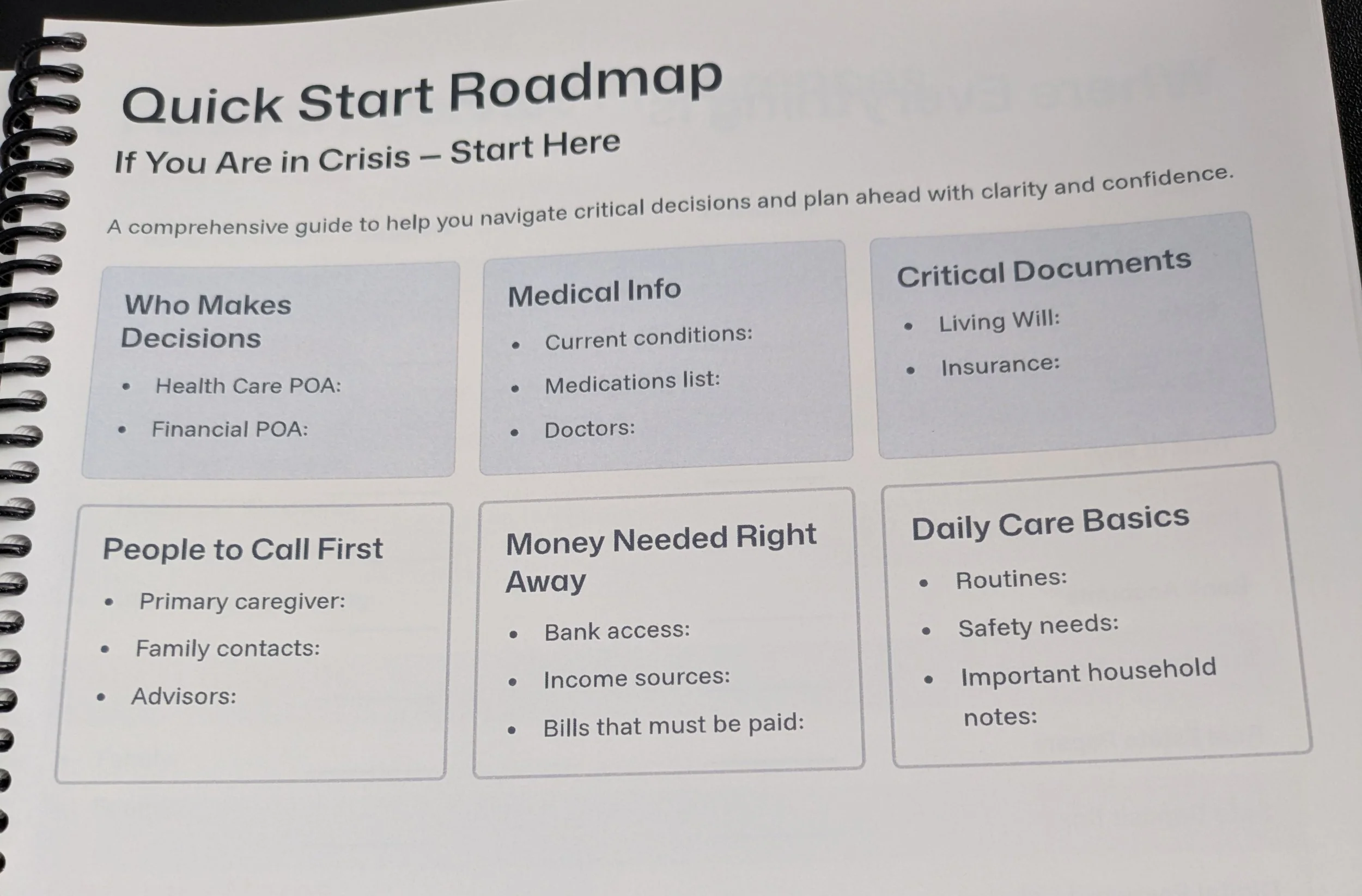

This professionally printed binder bundles all eleven guides, worksheets, and checklists into one beautifully organized package—no downloading, no printing, no assembling. Just open it and begin.

Printed on premium paper with flexible binding and clean, colorful layouts, the Clarity Binder makes planning simple for every family member. It also includes several exclusive resources not available for download, such as the Quick-Start Guide and the Estate & Care Planning Basics Guide. Everything you need is packaged neatly in one place, giving you clarity without the clutter.

When a crisis hits, the last thing you want is to scramble for phone numbers, policies, or legal documents. The Key People and Documents Worksheet keeps everything essential in one place—clear, organized, and ready when you or your loved ones need it most.

This worksheet helps you:

List and update your trusted advisors and healthcare providers

Record who holds legal roles such as Power of Attorney, Trustee, or Personal Representative

Track key financial accounts, insurance policies, and property interests

Provide a roadmap for family members or caregivers during emergencies or transitions

Instead of scattered files or forgotten details, this tool gives you a single reference point that brings peace of mind and ensures nothing is overlooked. A small step today can spare your family stress, confusion, and costly mistakes tomorrow.

A holistic assessment designed to help retirees measure what truly makes life abundant.

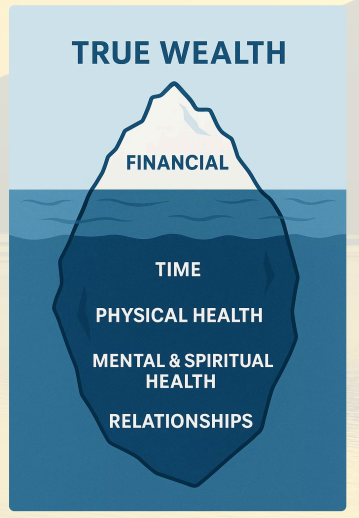

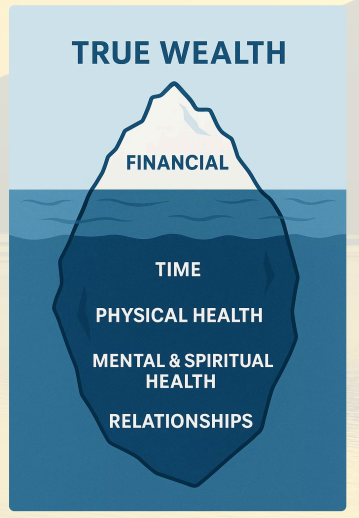

The Legacy Wealth Scorecard guides retirees through a clear and thoughtful self-assessment across six essential dimensions of True Wealth: Time, Financial Independence, Physical Health, Mental Health, Spiritual Health, and Relationships. While most people focus on financial wealth—what sits above the surface—the Scorecard helps reveal the deeper areas that support a meaningful, balanced, and intentional life.

What This Assessment Helps You Do

Reflect honestly on your strengths and vulnerabilities across six categories

Identify what’s working and where your habits already support a healthy, intentional life

Spot areas that need attention, without judgment or overwhelm

Gain clarity on next steps, supported by practical scoring and interpretation guidance