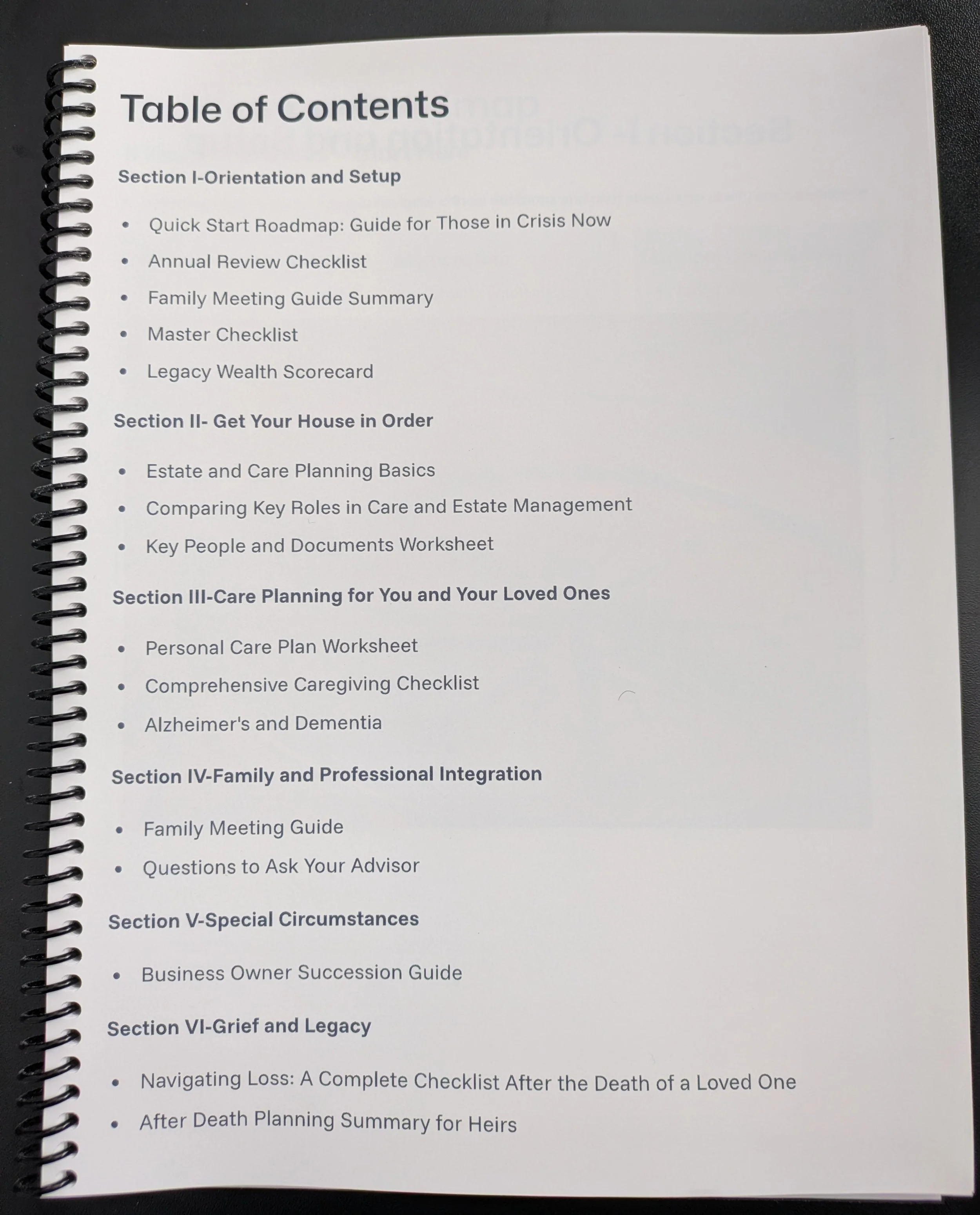

This professionally printed binder bundles all eleven guides, worksheets, and checklists into one beautifully organized package—no downloading, no printing, no assembling. Just open it and begin.

Printed on premium paper with flexible binding and clean, colorful layouts, the Clarity Binder makes planning simple for every family member. It also includes several exclusive resources not available for download, such as the Quick-Start Guide and the Estate & Care Planning Basics Guide. Everything you need is packaged neatly in one place, giving you clarity without the clutter.

The Clarity Before Crisis Master Checklist is a simple, high-level guide designed to help you quickly identify your priorities across financial planning, legal preparation, healthcare decisions, caregiving, and legacy planning. It doesn’t overwhelm you with details or require hours of work. Instead, it gives you a clear overview of the major areas that need attention so you can decide what to tackle first.

This checklist helps you:

See the full landscape of what aging, caregiving, and retirement planning involve

Spot gaps you may not have considered—before they become urgent

Determine your first steps based on what feels most important or most unfinished

Organize your thinking before diving into the detailed guides, worksheets, and planning tools in the broader Clarity System

It walks you through big-picture categories like:

What wealth and priorities mean to you Clarity-Before-Crisis-Master-Ch…

Your financial essentials

Key legal documents

Healthcare and long-term care decisions

Family conversations

Caregiving roles and responsibilities

Your values, stories, and legacy intentions

Where and how to store important documents

The Master Checklist doesn’t try to solve everything.

It simply helps you see everything, so you can decide where to begin.

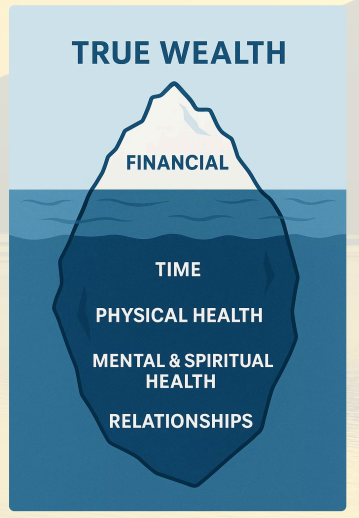

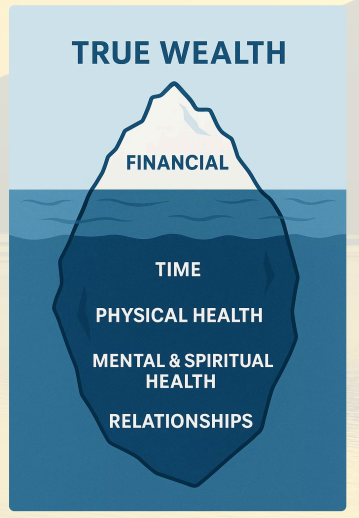

A holistic assessment designed to help retirees measure what truly makes life abundant.

The Legacy Wealth Scorecard guides retirees through a clear and thoughtful self-assessment across six essential dimensions of True Wealth: Time, Financial Independence, Physical Health, Mental Health, Spiritual Health, and Relationships. While most people focus on financial wealth—what sits above the surface—the Scorecard helps reveal the deeper areas that support a meaningful, balanced, and intentional life.

What This Assessment Helps You Do

Reflect honestly on your strengths and vulnerabilities across six categories

Identify what’s working and where your habits already support a healthy, intentional life

Spot areas that need attention, without judgment or overwhelm

Gain clarity on next steps, supported by practical scoring and interpretation guidance

Questions to Ask Your Financial Advisor is a practical, easy-to-use guide designed to help individuals and families ask better, deeper questions about retirement planning, taxes, investments, estate planning, healthcare, and legacy decisions. It serves as a conversation framework you can bring to an advisor meeting to ensure you receive clear, transparent guidance—not sales pitches.

This guide empowers you to:

Evaluate the competence and credibility of a financial advisor

Understand what questions truly matter for retirement and estate planning

Make confident decisions with clear, informed expectations

It helps ensure your advisor is not just managing investments—but supporting your long-term goals, your family, and your legacy.

A simple guide that brings clarity to the most confusing—and most important—responsibilities in aging, caregiving, and estate planning.

When a family is facing aging, illness, or loss, one of the biggest sources of conflict and confusion is not knowing who is supposed to do what. This guide gives you a clear, side-by-side breakdown of the essential roles involved in care and estate management, so you can assign responsibilities with confidence and avoid the emotional and financial chaos that often comes later.

Each role includes:

Responsibilities

Limitations

When the role becomes active

Who serves as the backup

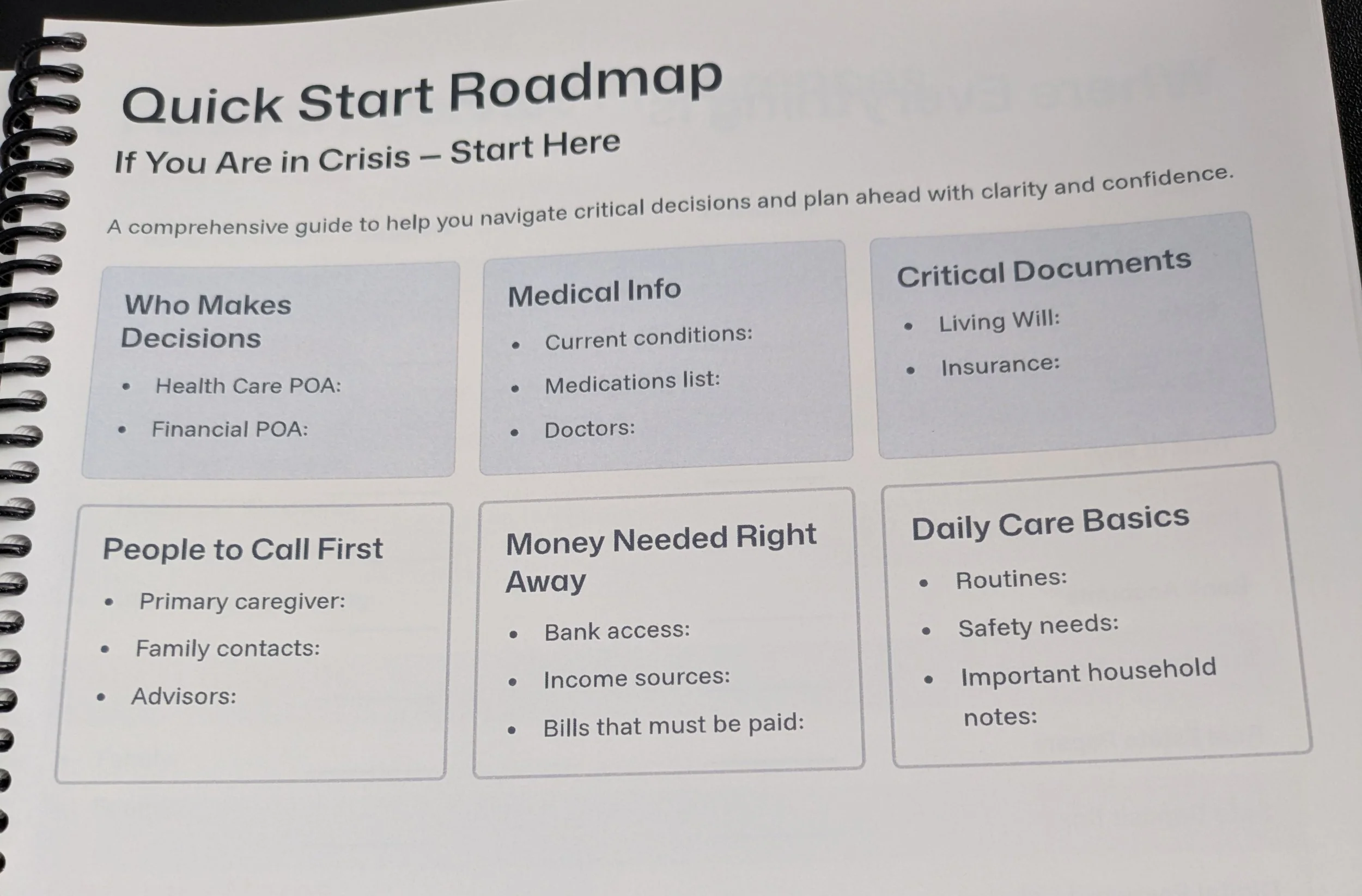

When a crisis hits, the last thing you want is to scramble for phone numbers, policies, or legal documents. The Key People and Documents Worksheet keeps everything essential in one place—clear, organized, and ready when you or your loved ones need it most.

This worksheet helps you:

List and update your trusted advisors and healthcare providers

Record who holds legal roles such as Power of Attorney, Trustee, or Personal Representative

Track key financial accounts, insurance policies, and property interests

Provide a roadmap for family members or caregivers during emergencies or transitions

Instead of scattered files or forgotten details, this tool gives you a single reference point that brings peace of mind and ensures nothing is overlooked. A small step today can spare your family stress, confusion, and costly mistakes tomorrow.

This guide provides a step-by-step roadmap for families handling the complex responsibilities that follow the death of a loved one. It brings order to an overwhelming time by outlining the essential administrative tasks, legal requirements, financial duties, and emotional considerations that arise immediately after a loss. It brings clarity to legal steps, financial responsibilities, and family dynamics—helping survivors move forward with confidence and care.

A dedicated section provides a concise, beginner-friendly process for beneficiaries:

Take time before acting

Gather key information

Understand what kind of assets you’re inheriting

Be aware of taxes

Follow a simple step-by-step plan

Avoid common mistakes

Know when to seek professional help

The Personal Care Plan Worksheet is a practical tool that helps individuals and families prepare for future care needs in a structured, proactive way. It guides you through assessing Activities of Daily Living (ADLs), identifying cognitive or mobility challenges, and documenting the level of support you may require now or in the future.

The worksheet walks through preferred care settings—whether aging at home, moving in with family, or transitioning to assisted living or memory care—and prompts you to record caregiver roles, respite plans, and review schedules. It also helps define responsibilities for transportation, meals, medical decisions, home maintenance, and more. Legal authority (such as Powers of Attorney and advance directives), funding sources for care, communication processes, and emergency contacts are all captured in one place.

Together, these sections create a personalized plan that reduces stress, eliminates confusion, and ensures everyone involved in your care understands your wishes and their responsibilities.

The Comprehensive Caregiving Checklist is a practical, structured tool designed to help caregivers stay organized across the legal, medical, emotional, and everyday responsibilities that come with supporting a loved one. It serves as a high-level framework to ensure nothing essential is overlooked—especially during an already overwhelming season.

This checklist serves as an organizing tool for caregivers navigating one of life’s most challenging roles. It provides clarity across legal, medical, emotional, and practical needs—helping caregivers stay prepared, supported, and capable of delivering compassionate, consistent care.

A structured, compassionate roadmap for the conversations every family avoids—until they can’t.

The Family Care Meeting Guide gives families a clear, step-by-step framework for discussing care needs, medical decisions, legal plans, responsibilities, and emotions with clarity and unity. Instead of waiting for a crisis to force the conversation, this guide helps you gather the right people, the right documents, and the right questions before things become urgent.

Family-Care-Meeting-Guide (1)

Inside, you’ll learn when to hold a family meeting, how to prepare for it, and what to cover—ensuring everyone is heard, informed, and aligned.

The Alzheimer’s & Dementia guide offers clear, compassionate direction for families navigating the emotional and logistical challenges of cognitive decline. It acknowledges the grief, confusion, and exhaustion caregivers face, while reassuring them that they are not failing and do not have to manage this journey alone. The guide clarifies what caregivers should document, what questions to ask, and when to involve medical, legal, and care-coordination professionals—because dementia fundamentally changes how decisions must be made.

It also explains the critical concepts of capacity and consent, encourages building a specialist team early, and outlines how care needs evolve over time. Safety risks, wandering, medication issues, behavioral changes, and caregiver burnout are highlighted as cues to seek immediate help. Additional pages provide trusted resources including the Alzheimer’s Association Helpline, elder law attorneys, geriatric care managers, and national dementia-care tools. Together, the guide offers clarity, next steps, and support for one of the most overwhelming family challenges.

The Business Owner Planning & Succession Guide helps business owners protect their life’s work by organizing the key decisions, documents, and conversations required for a smooth transition. It begins by recognizing that a business is part of one’s legacy and outlines four foundational areas of transition planning: succession and exit planning, leadership continuity, financial and legal protection, and real estate or rental property considerations. Each section includes prompts and checklists to identify successors, document procedures, review legal structures, and prepare the business to run without the owner.

The guide then walks owners through exit strategy options—internal succession, external sale, installment sales, ESOPs, charitable trusts, or wind-downs—and provides the “10 Pillars of a Successful Exit,” covering personal goals, valuation, tax strategy, legal readiness, timing, and life after the transition. It includes tools such as a 10-year vision worksheet, accountability chart, metrics scorecard, unresolved issues list, and a 90-day / 6–12 month / 1–3 year action plan.

Additional templates include a one-page succession plan, communication plan, and a family meeting guide that helps owners align expectations, clarify roles, and educate heirs on transition tools like buy-sell agreements, key person insurance, trusts, and ESOPs. Together, this guide provides a structured, practical path for business owners to secure continuity, reduce risk, and ensure their business legacy endures with clarity and purpose.